As noted above, a company’s interest coverage ratio is an indicator of its financial health and well-being. Coverage refers to the length of time—ordinarily the number of fiscal years—for which interest payments can be made with the company’s currently available earnings. The interest coverage ratio is sometimes called the times interest earned (TIE) ratio.

- Notably, to use the same accurately, one must find out more than just the interest coverage ratio meaning.

- EBITDA has become a popular metric in financial analysis because many people view it as a close approximation to a company’s ability to generate free cash flow.

- It’s important to note that interest expense can include more than just the interest on debt.

- This measurement is used by creditors, lenders, and investors to determine the risk of lending funds to a company.

- It also helps to assess the profitability of the aforementioned company.

Usually, when practitioners mention the “interest coverage ratio”, it is reasonable to assume they are referring to EBIT. Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print and online publications. While this way is fairly common, be sure to ask your lender how they calculate DSCR for the most accurate ratio.

What is the importance of the interest coverage ratio?

If you don’t meet their DSCR requirements, they may say you’re in violation of your loan agreement and expect you to pay the loan in full within a short time period. Your business earns $65,000 in revenue annually but pays $15,000 in operating expenses. Your net operating income is your total revenue or income generated from selling products or services, minus your operating expenses. A ratio of one or above is indicative that a company generates sufficient earnings to completely cover its debt obligations. Low Ratio – Low coverage ratio shows the company is burdened by debt expenses and doesn’t earn enough EBIT relatively to its interest expenses.

- A ratio of one or above is indicative that a company generates sufficient earnings to completely cover its debt obligations.

- If a company has a low-interest coverage ratio, there’s a greater chance the company won’t be able to service its debt, putting it at risk of bankruptcy.

- This ratio can also help lenders determine the borrowing amount they can offer you.

- The interest coverage ratio (ICR) is preferred to be calculated by quarters, but it is the same result with yearly data.

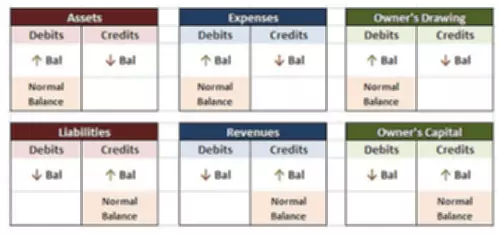

All else held equal, this would be a sustainable but not particularly comfortable position for most companies. A ratio of just 0.5x, by contrast, would mean that a company is spending twice as much on interest as it earns in EBIT every year. The Interest Coverage Ratio can be calculated using two primary ratios.

Interest Coverage Ratio Example

Hence, it is required to find a financial ratio to link earnings before interests and taxes with the interest the company needs to pay. With it, you can not only track when a company is earning more money than the interest it has to pay but also when the earnings are getting worse and the risk of credit default is increasing. A company with very large current earnings beyond the amount required to make interest payments on its debt has a larger financial cushion against a temporary downturn in revenues. A company barely able to meet its interest obligations with current earnings is in a very precarious financial position, as even a slight, temporary dip in revenue may render it financially insolvent.

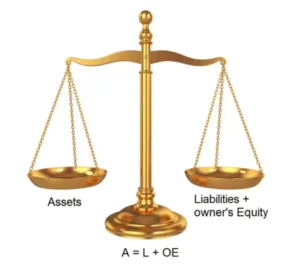

The interest coverage ratio (ICR) is a measure of a company’s ability to meet its interest payments. Interest coverage ratio is equal to earnings before interest and taxes (EBIT) for a time period, often one year, divided by interest expenses for the same time period. The interest coverage ratio is a measure of how many times a company could pay the interest on its debt with its EBIT. It determines how easily a company can pay the interest expense on outstanding debt. The interest coverage ratio measures a company’s ability to handle its outstanding debt.

What is the financial ratio interest coverage?

We calculated your current DSCR at 1.67, which means you have an extra 67% of income after you’ve paid your debts. This is well above the 1.25 DSCR mark, but it doesn’t necessarily indicate the size of the loan you can reasonably afford to borrow. Some lenders calculate your debt service coverage using your EBITDA (earnings before interest, taxes, depreciation, and amortization) instead of your EBIT.

Country Ceiling Limits Most Turkish Corporates’ Ratings After Election – Fitch Ratings

Country Ceiling Limits Most Turkish Corporates’ Ratings After Election.

Posted: Mon, 19 Jun 2023 10:56:00 GMT [source]

As a rule of thumb, you should not own a stock or bond with an interest coverage ratio below 1.5, Many analysts prefer to see a ratio of 3.0 or higher. A ratio below 1.0 indicates the company has trouble generating the cash needed to pay its interest obligations. Higher ratios are better for companies and the historical cost principle and business accounting industries that are susceptible to volatility. But lower coverage ratios are often suitable for companies that fall in certain industries, including those that are heavily regulated. For instance, it’s not useful to compare a utility company (which normally has a low coverage ratio) with a retail store.

Why You Can Trust Finance Strategists

This type of company is at risk of defaulting on its loans and is likely to have difficulty securing new financing. However, as with any metric meant to assess a business’ efficiency, the interest coverage ratio is not absolute. For instance, a ratio of 2 is often considered standard for more stable companies in specific industries. This is because production and revenue are almost constant, which means they can probably cover all of their interest payments even if interest was low. For more volatile industries, such as manufacturing, a higher minimum interest coverage ratio such as 3 would be deemed acceptable. That said, there can be a limit to how high an optimal interest coverage ratio would be.