Content

If the management at a later date decides to decrease the balance in the petty cash account, the previous entry would be reversed, with cash being debited and petty cash being credited. The journal entry for this action involves debits to appropriate expense accounts as represented by the receipts, and a credit to Cash for the amount of the replenishment. Notice that the Petty Cash account is not impacted — it was originally established as a base amount, and its balance has not been changed by virtue of this activity. Policies should be established regarding appropriate expenditures that can be paid from petty cash.

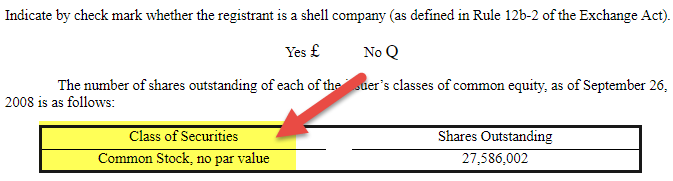

- Upon review of the box, the balance is counted in the following way.

- It requires determining the difference between the value of monetary transactions recorded in the system with actual cash.

- Almost every company finds it necessary to pay small amounts for a great many things such as employees lunches, and taxi fare, purchase of minor office supply items, and small expense payments.

- Create a petty cash log that details what was purchased, the amount of the purchase, the date it was purchased, the account affected (e.g., Office Supplies account), and which employee received the funds.

- The customer should have paid $100 for their purchase but they only paid $90.

Whatever the cause, the available cash must be brought back to the appropriate level. A firm will note cash variation instances easily in a single accessible account. A cash short and over account should be known as an income tax account, not just an expense account even though the errors reported can decrease or increase the earnings of a company on its tax of income.

Journal entry for removing money from the petty cash fund

You would use your petty cash fund to reimburse your employee for the purchase of the supplies. A basic cash control is preparation of a monthly bank reconciliation. The bank reconciliation, when properly prepared, proves that the cash balance per bank and the cash balance per book are in agreement.

- Items that present classification problem are postdated checks, IOUs, travel advances, postage stamps, and special cash funds.

- For example, employees cannot use petty cash to buy themselves coffee.

- A company creates a voucher each time the petty cash account is used.

- For petty cash reconciliation, subtract the amount in your petty cash fund from the amount stated in your books.

- However, when the company’s accountant goes to count the cash, they only find $190.

- If the management at a later date decides to decrease the balance in the petty cash account, the previous entry would be reversed, with cash being debited and petty cash being credited.

Establishing a dollar amount to meets your business’s petty cash needs is essential. Make sure your employees understand what the petty cash fund can or can’t be used for by creating a petty cash policy. Under the imprest system the petty cash custodian is responsible at all times for the amount of the fund on hand either as cash or in the form of signed vouchers. Items that present classification cash short and over problem are postdated checks, IOUs, travel advances, postage stamps, and special cash funds. Travel advances are properly treated at receivables if the advances are to be collected from the employees or deducted from their salaries. Otherwise, classification of the travel advance as prepaid expense is more appropriate postdated checks and IOUs are treated as receivables.

What Does Cash Over Short Mean?

You must document each expense if you want to deduct it from your business taxes. If you don’t document your petty cash purchases, you will not be able to deduct the expenses when you pay business taxes. You might debit multiple accounts, depending on how often you update your books for petty cash accounting. You (or your petty cash cashier) must also create journal entries showing what petty cash funds go toward.

For example, a company would be cash over $8 if its general ledger showed a balance of $200 for its cash fund but the company actually had $133 in cash and $75 in receipts (for a total of $208). Cash over situations can be thought of as the opposite of cash short situations. Cash over occurs when there is more cash on hand than what was expected/recorded in a company’s general ledger. A controller conducts a monthly review of a petty cash box that should contain a standard cash balance of $200. He finds that the box contains $45 of cash and $135 of receipts, which totals only $180. This cash shortfall is recorded as a debit to the cash over and short account (which is an expense) and a credit to the petty cash or cash account (which is an asset reduction).

How to Account for Credit Card Sales

The journal entry to establish the petty cash fund would be as follows. As with cash short situations, businesses should keep an eye on cash over situations in order to accurate accounting or other mistakes. This helps to ensure that the company is not overcharging its customers or giving back incorrect amounts of change. A firm should note instances of cash variances in a single, easily accessible account. This cash-over-short account should be classified as an income-statement account, not an expense account because the recorded errors can increase or decrease a company’s profits on its income statement.

Now subtract the amount remaining from the account’s original balance to determine by how much you need to replenish the account. In the example, if your petty cash account’s original balance was $1,000, subtract $550 from $1,000 to get $450, which is the amount by which you need to replenish the account. If the cash recorded in the register is higher than the physical cash in hand, it falls under cash short.

What is petty cash?

Like any other type of transaction, you must record petty cash transactions in your small business accounting books. Read on to learn about establishing a petty cash fund, handling petty cash accounting, reconciling your petty cash account, and claiming a tax deduction. In the above form of bank reconciliation the bank balance is reconciled to the unadjusted balance of the depositors cash account in the general ledger. Then, the required adjustment to the cash account is entered in the bank reconciliation resulting in the correct cash balance. Cash and cash equivalents are part of the current assets section of the balance sheet and contribute to a company’s net working capital. Net working capital is equal to current assets, less current liabilities.

Is cash a short or long term asset?

Short-term assets are cash, securities, bank accounts, accounts receivable, inventory, business equipment, assets that last less than five years or are depreciated over terms of less than five years. Also called current assets.

Because the maintenance of compensating cash balances affects liquidity and the effective cost of borrowing from banks, users of financial statements may find such information useful. A bank reconciliation is the process of accounting for the difference between the balance of cash according to the company’s records. This process involves making additions to and subtractions from both balances to arrive at the adjusted cash balance. Occasionally, errors may occur that affect the balance of the petty cash account.

Cash Short And Over Account Definition

[IAS 1.88] Some IFRSs require or permit that some components to be excluded from profit or loss and instead to be included in other comprehensive income. That information, along with other information in the notes, assists users of financial statements in predicting the entity’s future cash flows and, in particular, their timing and certainty. Proper cash management involves the problem of liquidity Vs profitability.

Many small businesses will do this monthly, which ensures that the expenses are recognized within the proper accounting period. In the event that all of the cash in the account is used before the end of the established time period, it can be replenished in the same way at any time more cash is needed. If the petty cash account often needs to be replenished before the end of the accounting period, management may decide to increase the cash balance in the account.

A cashier working at a company’s retail store conducts a transaction with a customer in which the customer should have paid $100 for their purchase but they paid $110. The cashier did not notice this overpayment and accepted the $110 as full payment. The journal entry for this transaction would credit the sales account for $100, debit the cash account for $110, and credit the cash over and short account for $10. Company ABC has a petty cash fund that the general ledger records show as being at a balance of $50. The petty cash fund account currently has $32 in cash and $15 in receipts.